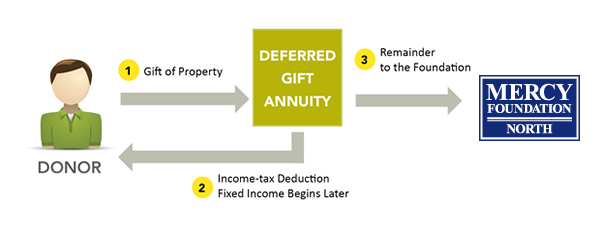

Deferred Charitable Gift Annuities

How it works

You transfer cash, securities or other property to Mercy Foundation North.

You transfer cash, securities or other property to Mercy Foundation North.

Beginning on a specified date in the future, Mercy Foundation North begins to pay you, or up to two annuitants you name, fixed annuity payments for life.

Beginning on a specified date in the future, Mercy Foundation North begins to pay you, or up to two annuitants you name, fixed annuity payments for life.

The principal passes to Mercy Foundation North when the contract ends.

The principal passes to Mercy Foundation North when the contract ends.

Benefits

- You receive an immediate income-tax deduction for a portion of your gift.

- You can postpone your annuity payments until you need them, such as when you reach retirement or when a grandchild begins his or her college education.

- The longer you defer your payments, the higher the effective rate you will receive. In the meantime, the principal grows tax-free.

- You can make a significant gift now that benefits both you and Mercy Foundation North later.

Consider a deferred gift annuity if you:

- Are in high earnings years, looking for both income-tax savings now and an additional source of revenue when you retire

- Want to make a significant gift to Mercy Foundation North and receive payments in return

- Want to maximize the payments you receive from your planned gift – and you want to lower your income tax on those payments

- Want the security of payments that won't fluctuate during your lifetime

- Appreciate the safety of your payments being a general financial obligation of the institution

Related Links

More about deferred charitable gift annuities

Gift example

Charitable gift annuity

Single Life Deferred Charitable Gift Annuity Rates

Two Lives Deferred Charitable Gift Annuity Rates

Download a brochure on this topic: