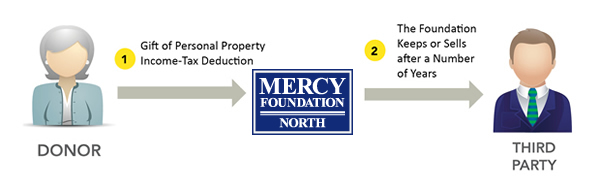

Gifts of Personal Property

How it works

You transfer valuable paintings, antiques, collectibles or other personal property to Mercy Foundation North.

The Foundation may hold

You transfer valuable paintings, antiques, collectibles or other personal property to Mercy Foundation North.

The Foundation may hold

The Foundation may hold on to the property and display or use it in the furtherance of its mission. Mercy Foundation North may sell the property at some point in the future and use the proceeds for its ministries.

The Foundation may hold on to the property and display or use it in the furtherance of its mission. Mercy Foundation North may sell the property at some point in the future and use the proceeds for its ministries.

Benefits

- You receive gift credit and an immediate income-tax deduction for the appraised value of your gift and pay no capital-gains tax, provided your gift satisfies the IRS' related use requirements.

- In certain cases, you can use personal property to fund a life-income gift, such as a FLIP Unitrust

- You can make a significant gift now to Mercy Foundation North without adversely affecting your cash flow. that benefits the Foundation and increase your cash flow.

Consider a gift of personal property if you:

- Have artwork, books or collectibles that you no longer wish to maintain

- Have equipment, supplies, or other items that would be useful to the Foundation and its ministries

- Want to avoid capital-gains tax on the transfer of these assets

Related Links

More about gifts of personal property